INITIAL COIN OFFERINGS AND THE VALUE OF CRYPTO TOKENS

Christian Catalini (MIT) and Joshua Gans (University of Toronto)

This paper explores how entrepreneurs can use initial coin offerings — whereby they issue crypto tokens and commit to accept only those tokens as payment for future use of a digital platform — to fund venture start-up costs. We show that the ICO mechanism allows entrepreneurs to generate buyer competition for the token, which, in turn, reveals consumer value without the entrepreneurs having to know, ex ante, consumer willingness to pay. We find that venture returns are independent of any committed growth in the supply of tokens over time, but that initial funds raised are maximized by setting that growth to zero to encourage saving by early participants. Furthermore, by revealing key aspects of consumer demand, crypto tokens may increase entrepreneurial returns beyond what can be achieved through traditional equity financing. A lack of commitment in monetary policy can, however, undermine saving and, thus, the cost of using tokens to fund start-up costs is potential inflexibility in future capital raising. Crypto tokens can also facilitate coordination among stakeholders within digital ecosystems when network effects are present.

MIT NewS: "Bitcoin study: Period of exclusivity encourages early adopters"

"Giving early adopters the first access to new technologies can help diffuse those technologies among the masses. A notable example is Google’s rollout of Gmail: In 2004, about 1,000 select users were given exclusive access and told to invite others. This campaign was so successful that..."

Read the full article

Download the first working paper on the MIT DIGITAL CURRENCY EXPERIMENT

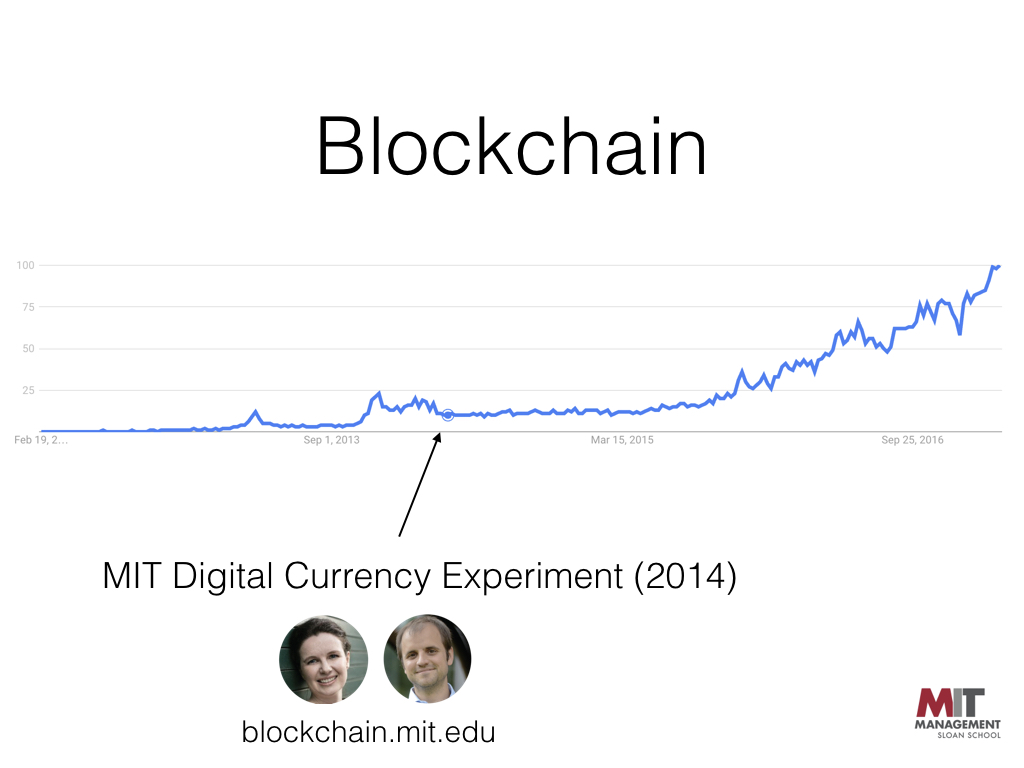

Seeding the S-Curve? The Role of Early Adopters in Technology Diffusion

by Christian Catalini (MIT Sloan) and Catherine Tucker (MIT Sloan)

August 11th, 2016

In October 2014, all 4,494 undergraduates at the Massachusetts Institute of Technology were given access to Bitcoin, a decentralized digital currency. As a unique feature of the experiment, students who would generally adopt first were placed in a situation where many of their peers received access to the technology before them, and they then had to decide whether to continue to invest in this digital currency or exit. Our results suggest that when natural early adopters are delayed relative to their peers, they are more likely to reject the technology. We present further evidence that this appears to be driven by identity, in that the effect occurs in situations where natural early adopters' delay relative to others is most visible, and in settings where the natural early adopters would have been somewhat unique in their tech-savvy status. We then show not only that natural early adopters are more likely to reject the technology if they are delayed, but that this rejection generates spillovers on adoption by their peers who are not natural early adopters. This suggests that small changes in the initial availability of a technology have a lasting effect on its potential: Seeding a technology while ignoring early adopters' needs for distinctiveness is counterproductive.

Download the full paper

SOME SIMPLE ECONOMICS OF THE BLOCKCHAIN

by Christian Catalini (MIT Sloan) and Joshua S. Gans (University of Toronto)

September 21st, 2017

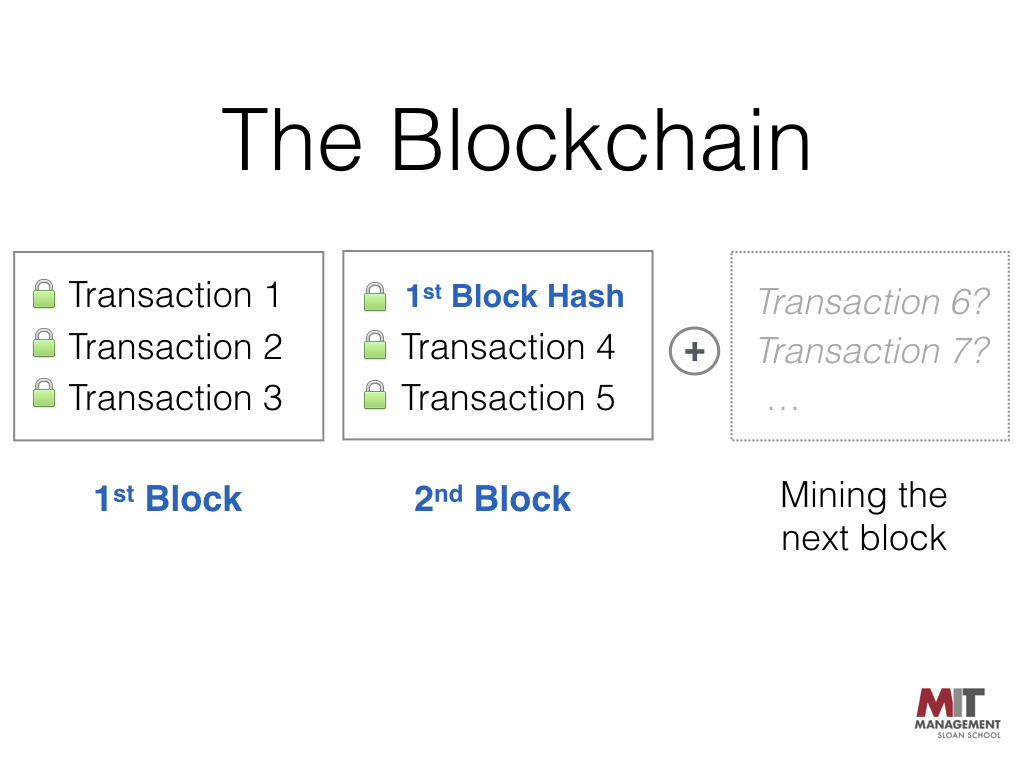

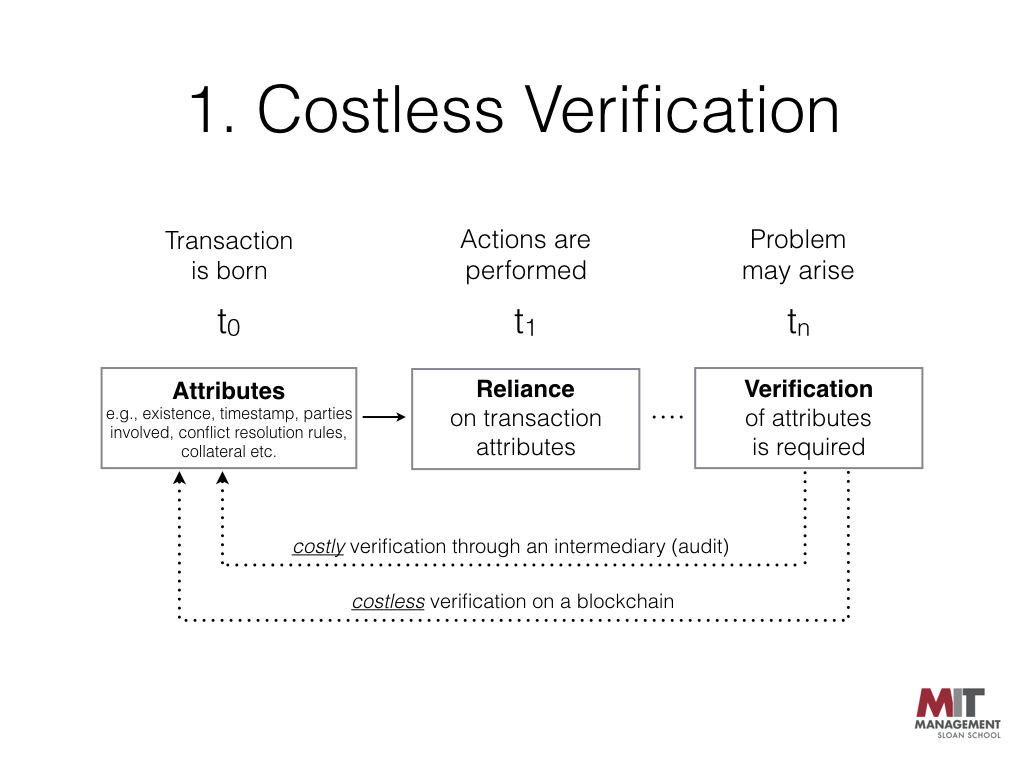

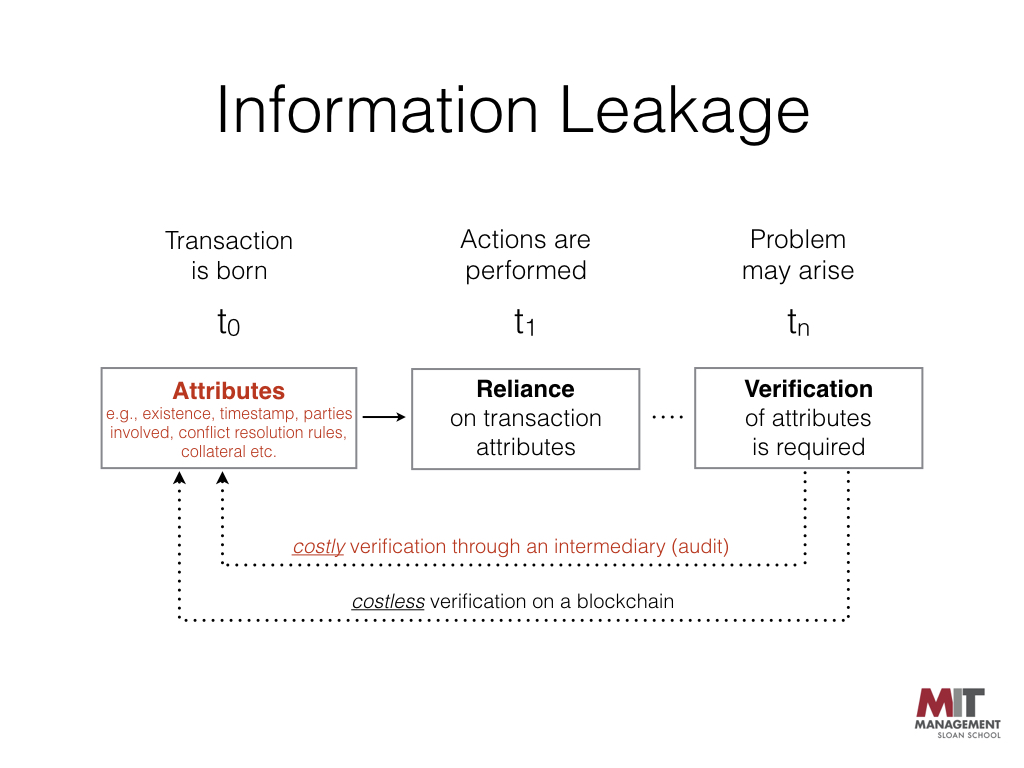

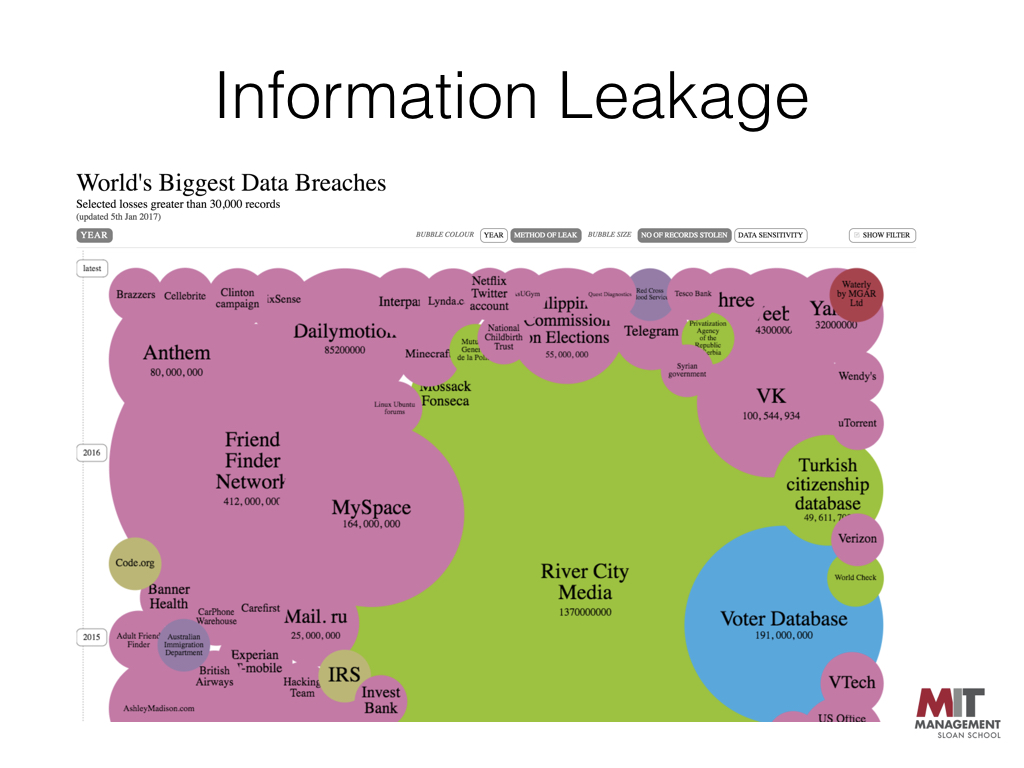

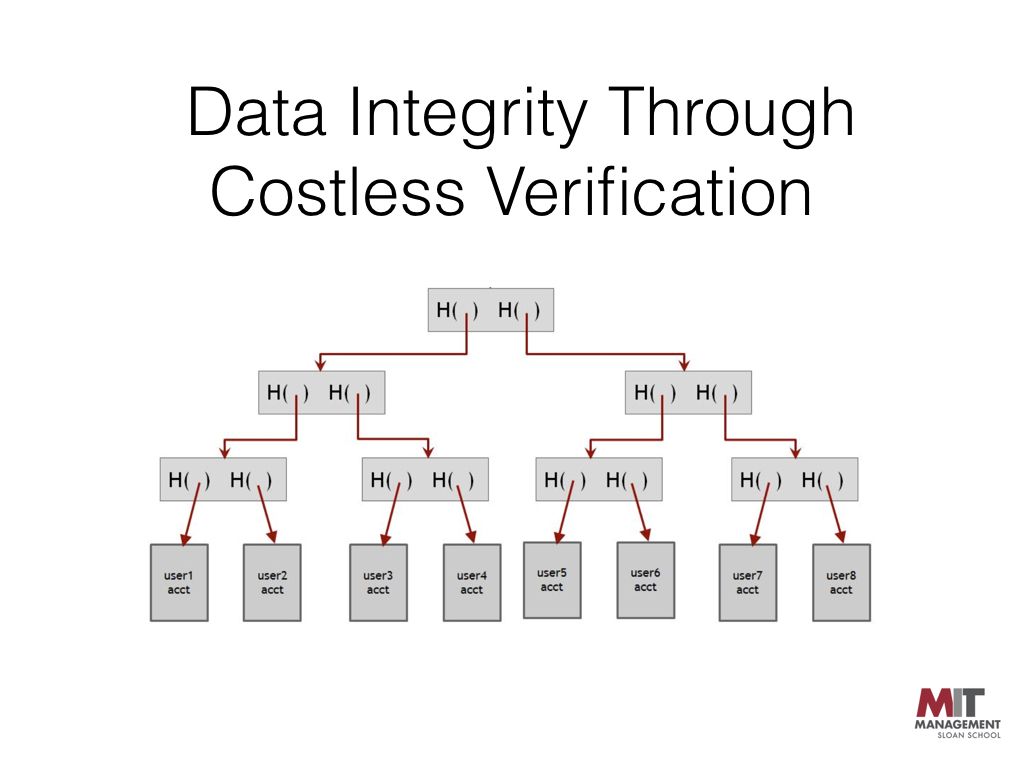

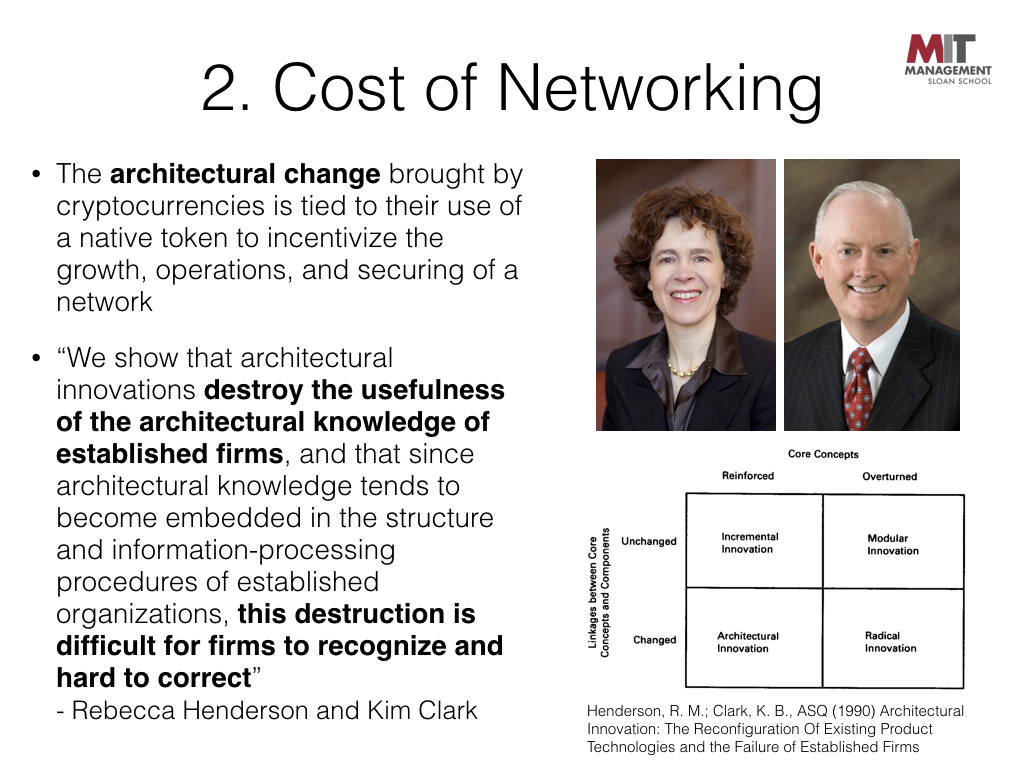

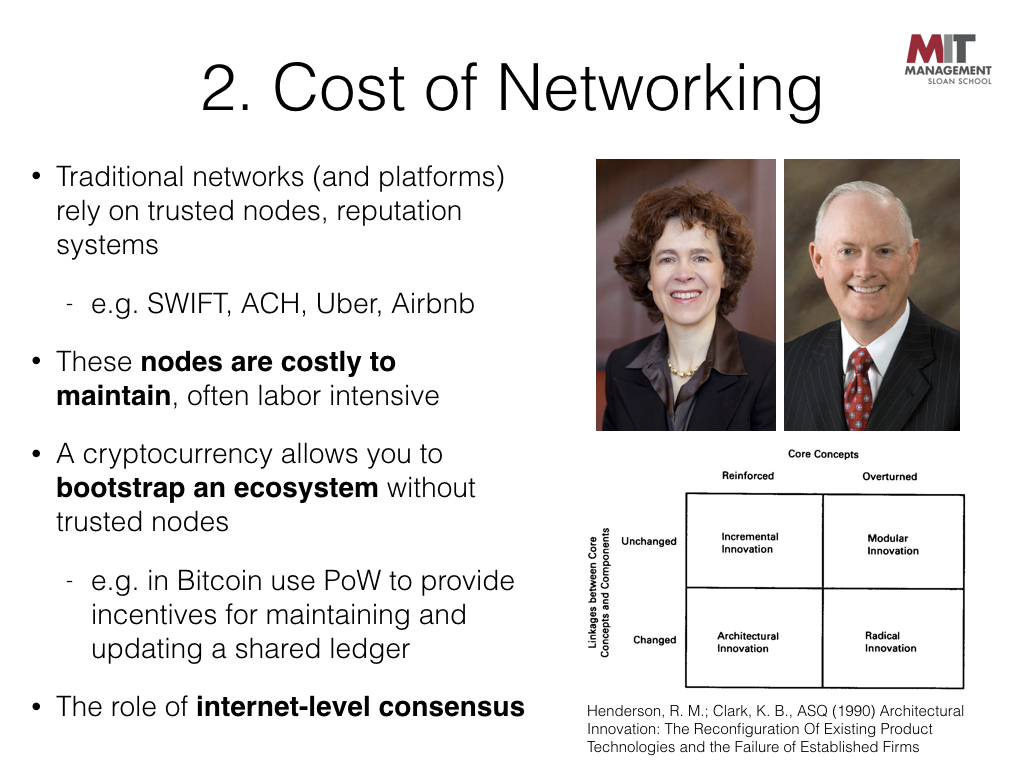

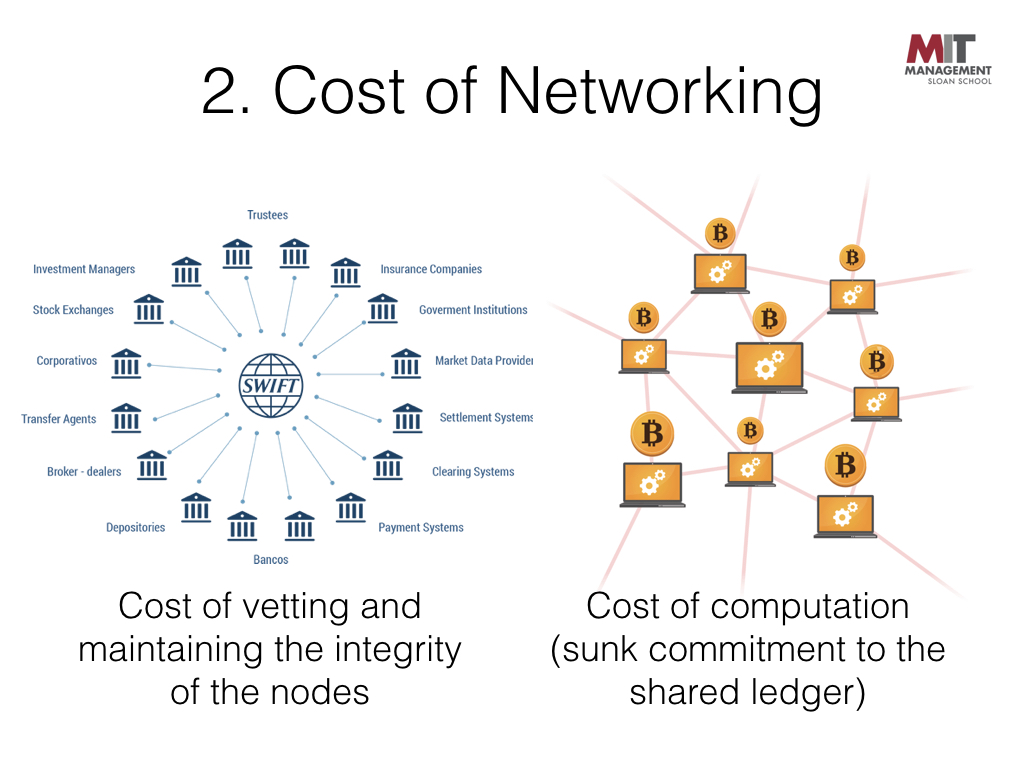

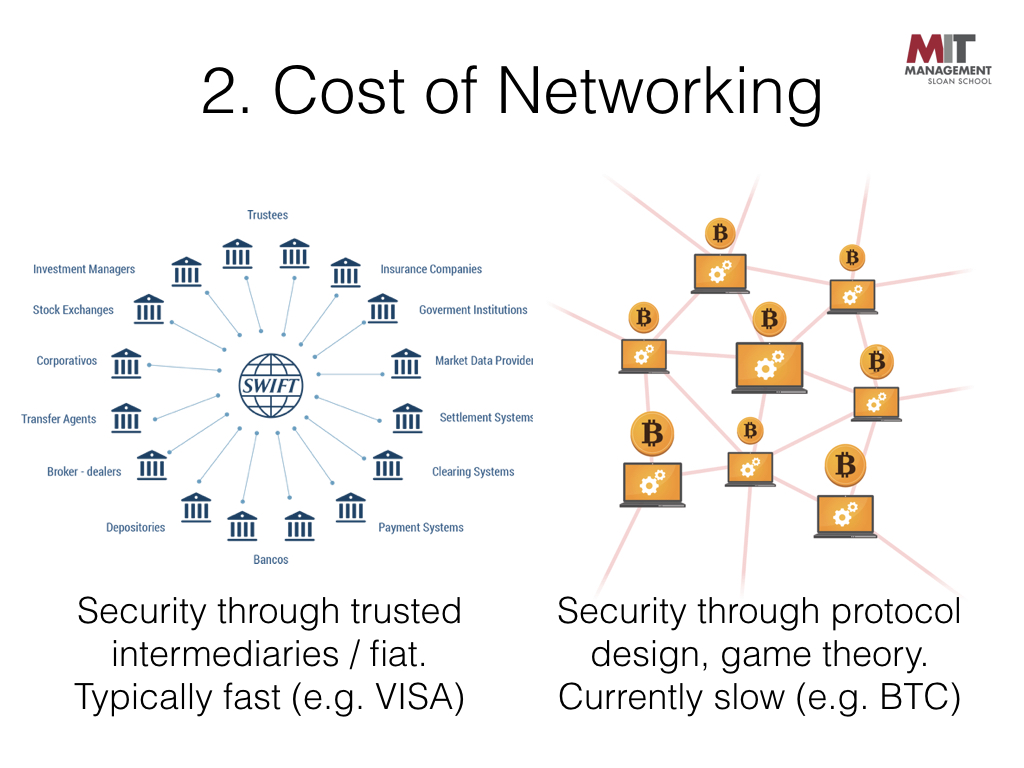

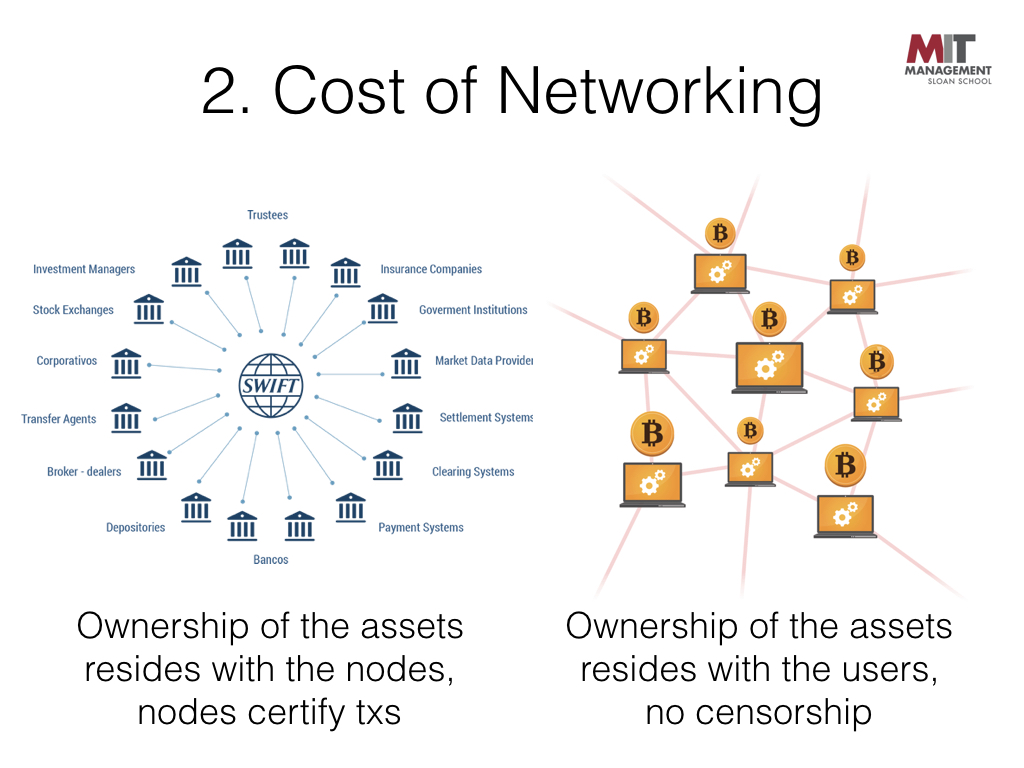

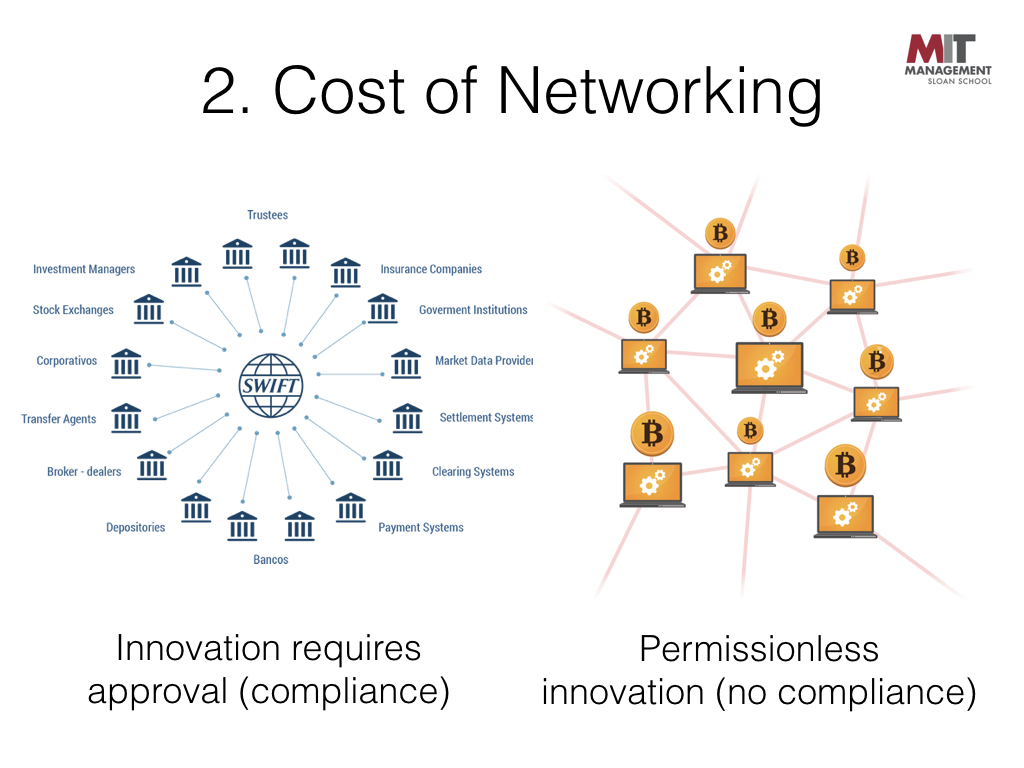

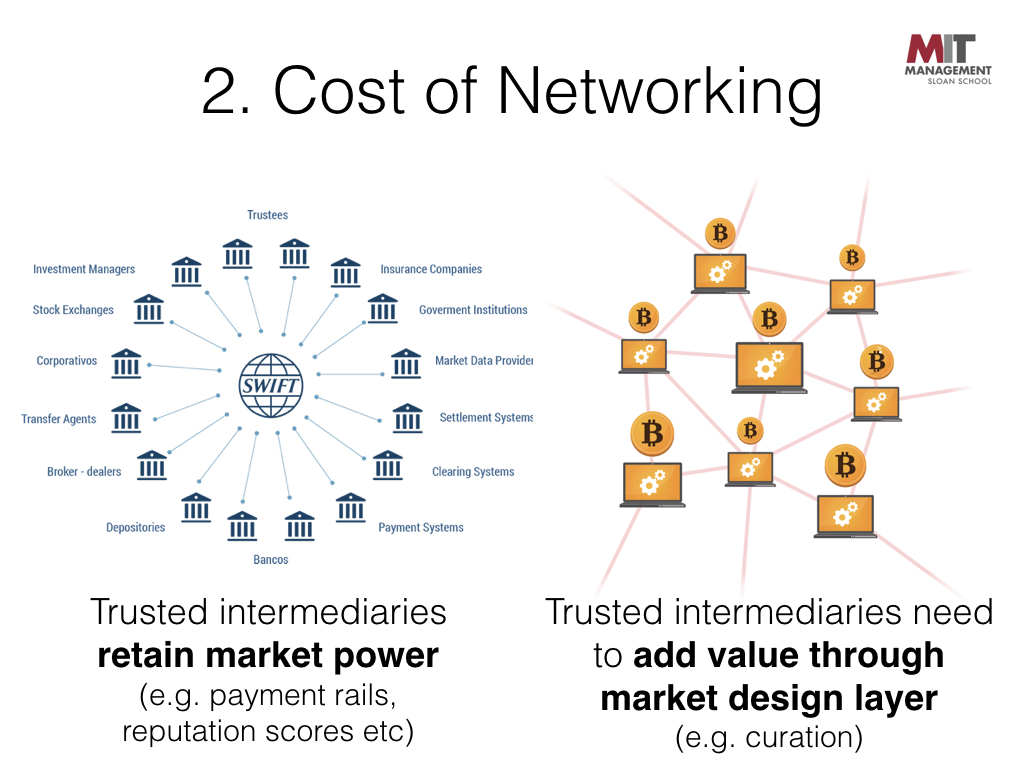

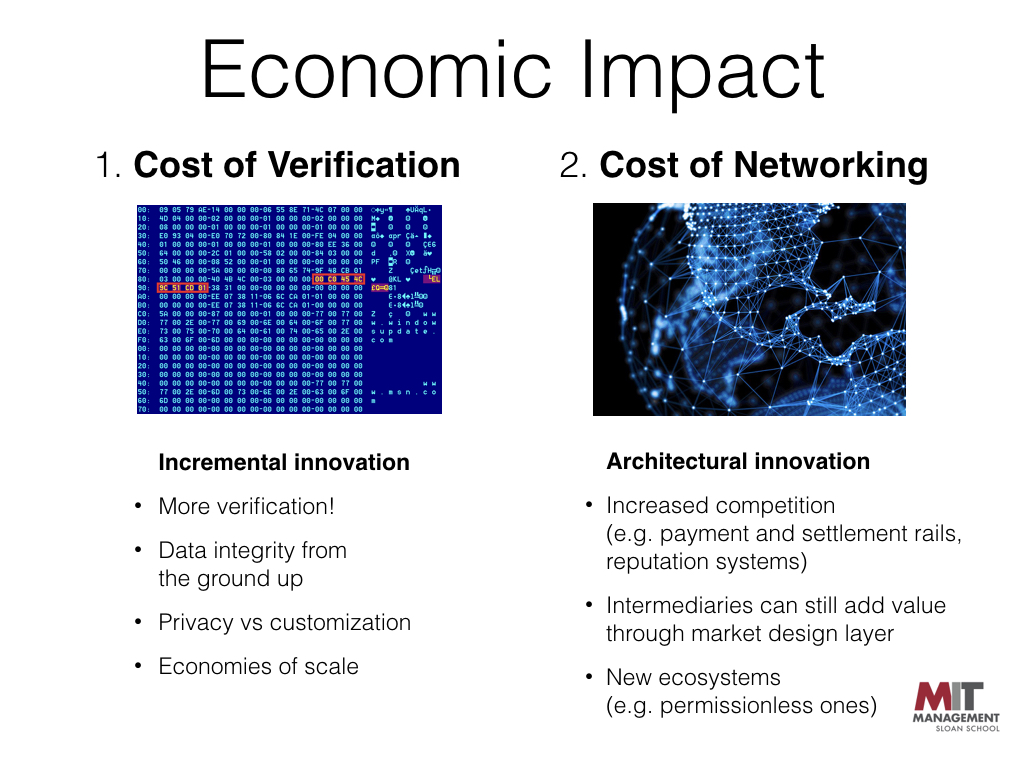

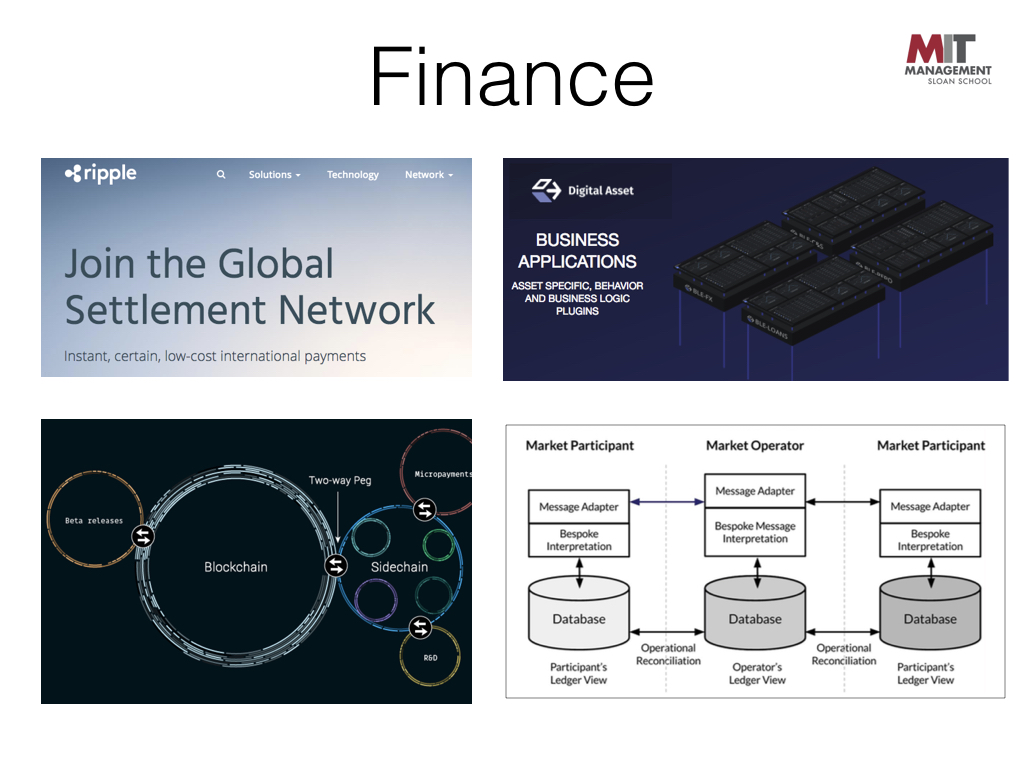

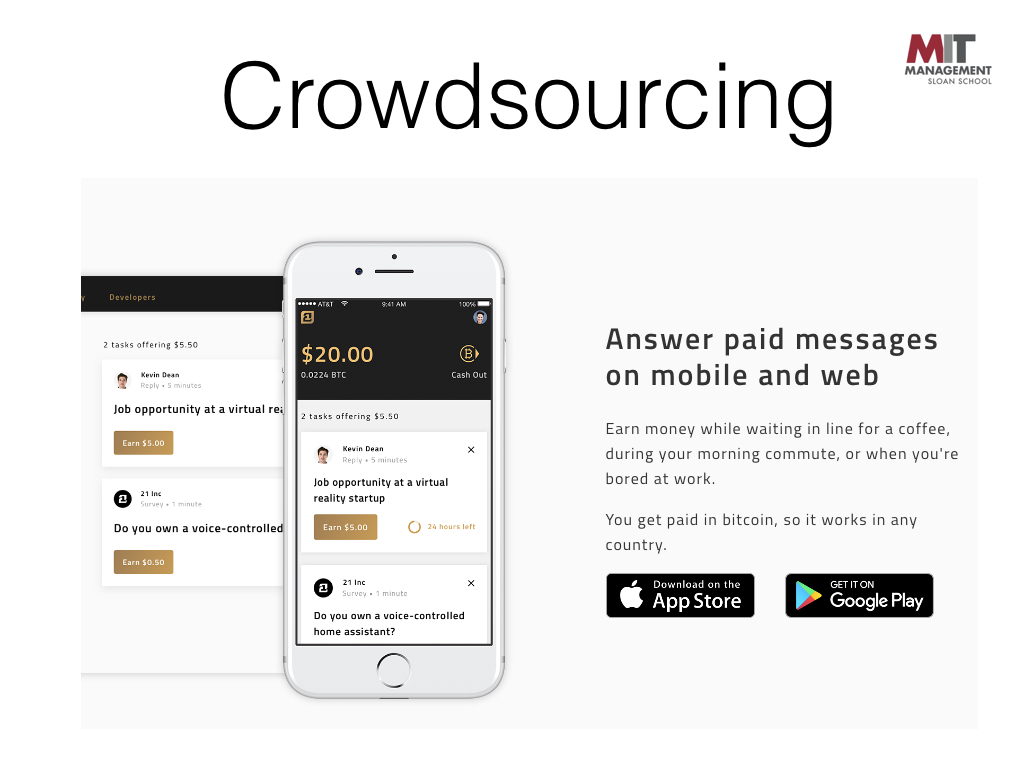

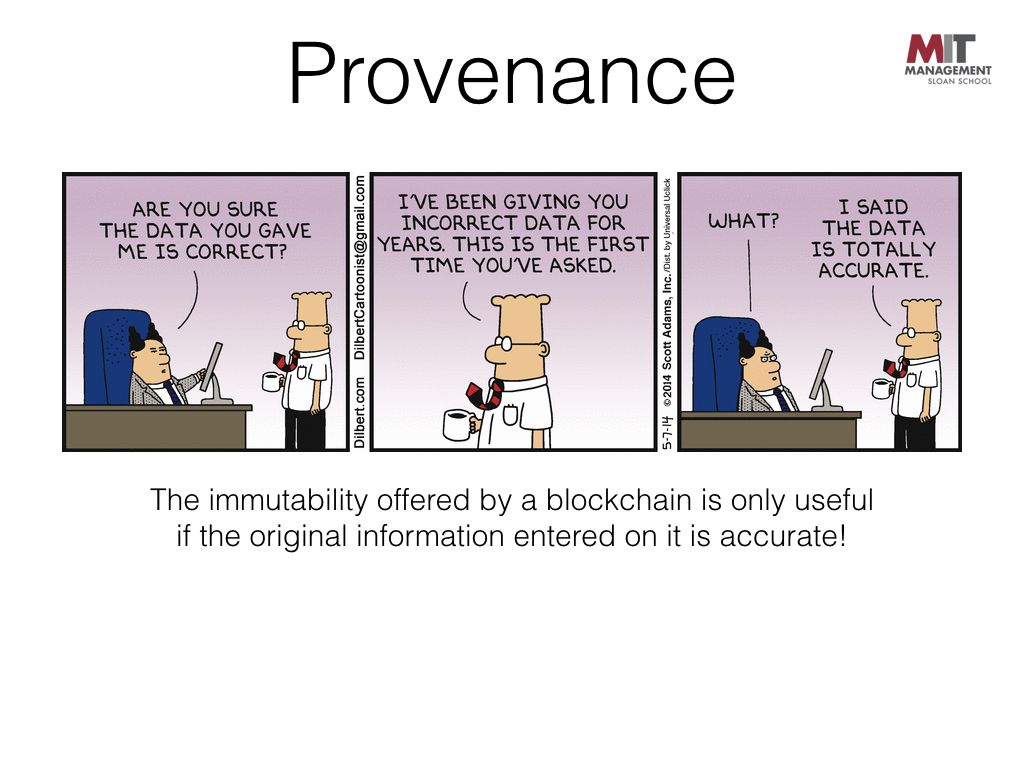

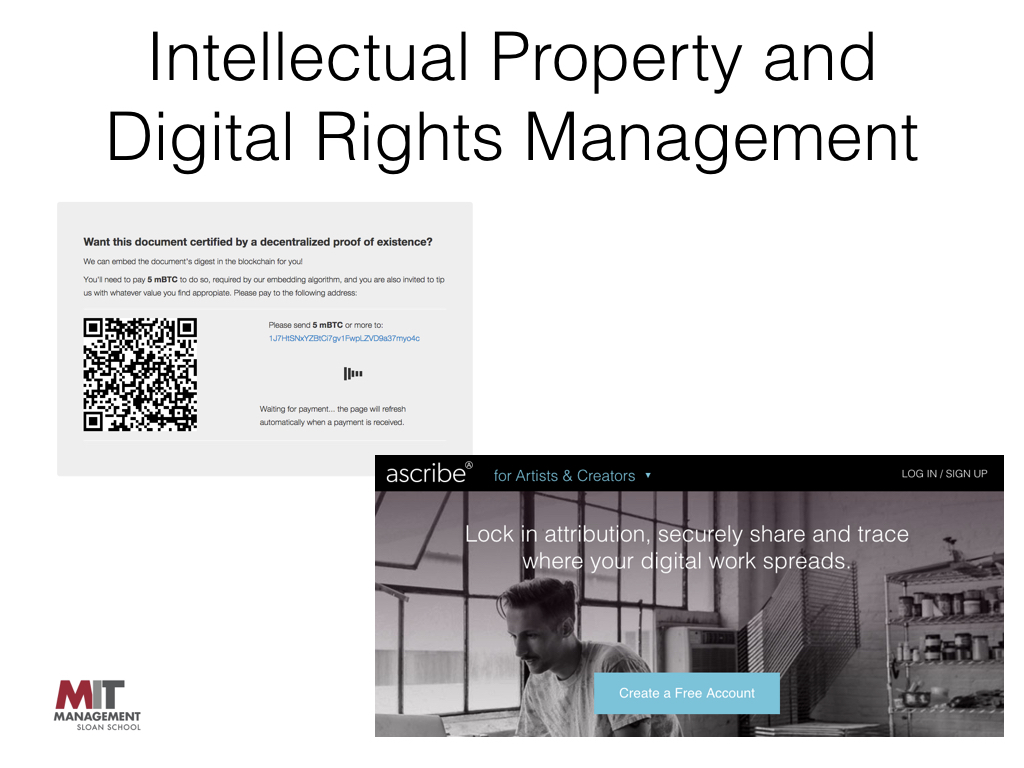

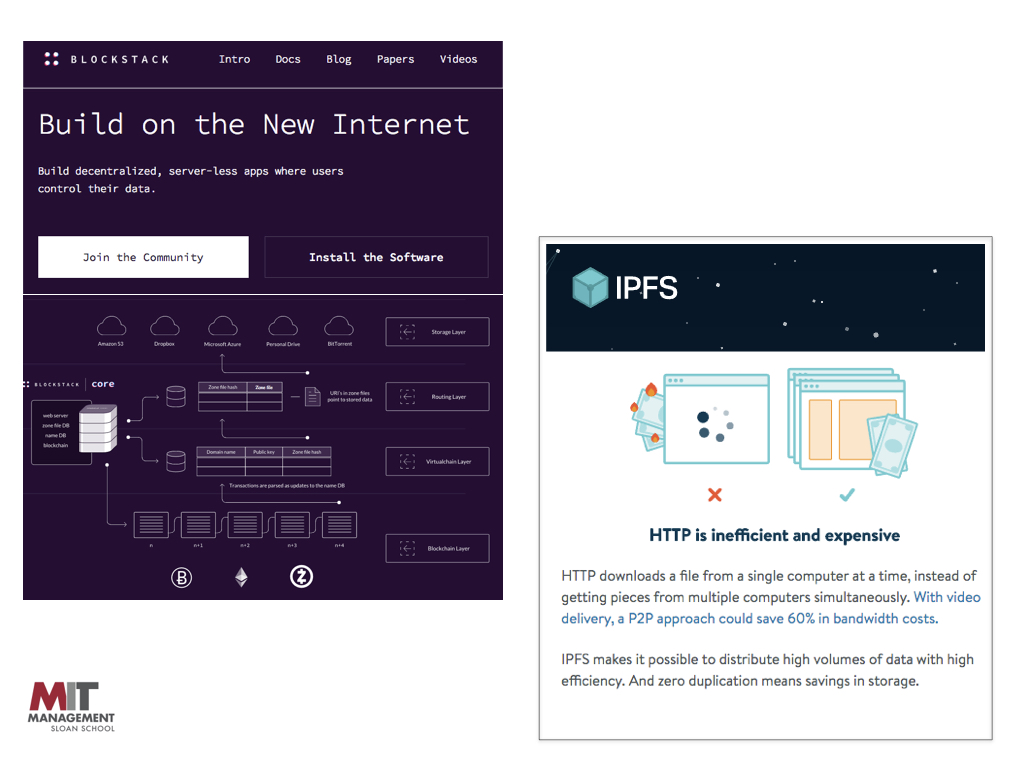

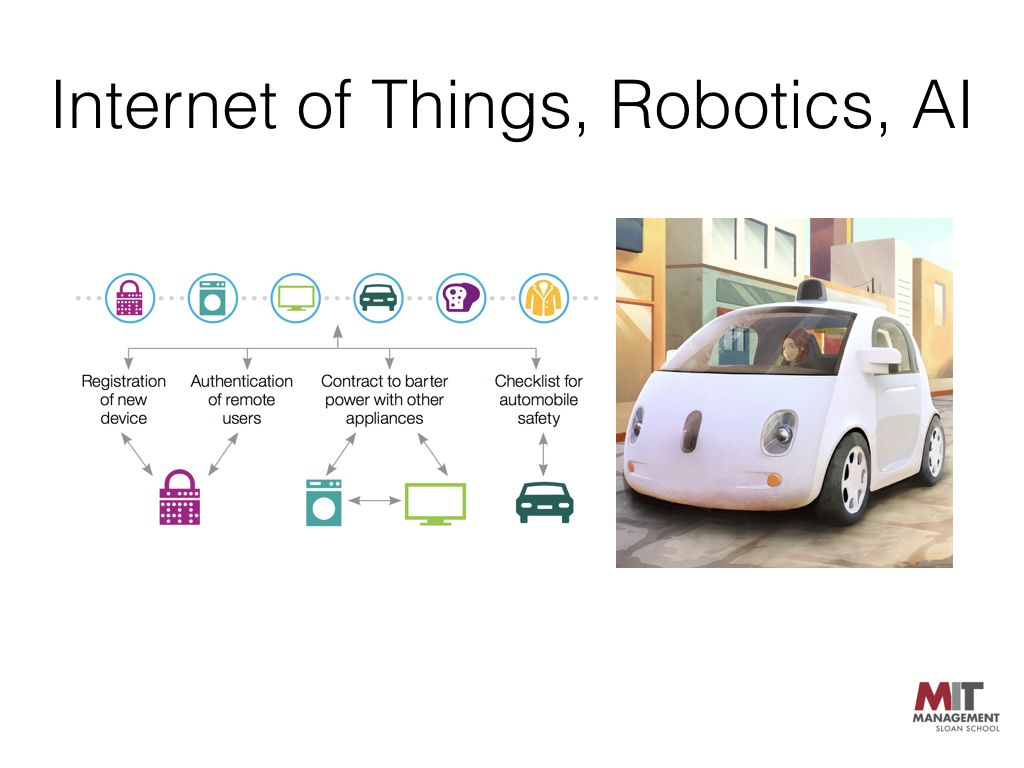

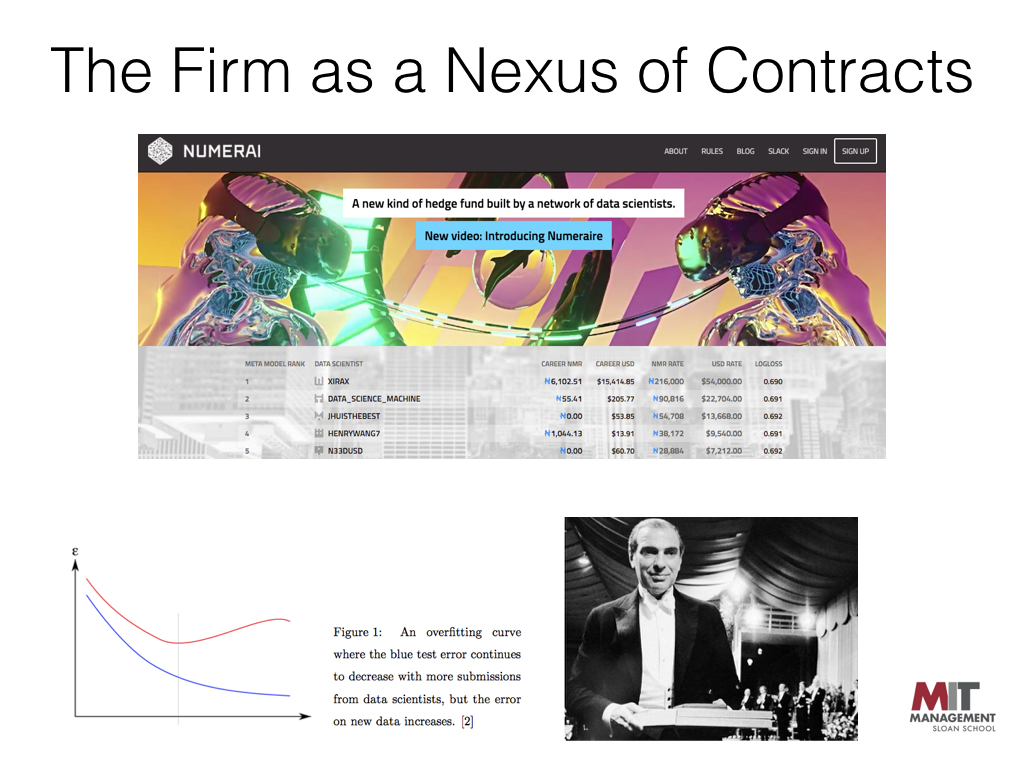

We rely on economic theory to discuss how blockchain technology will shape the rate and direction of innovation. We identify two key costs affected by the technology: 1) the cost of verification; and 2) the cost of networking. The first cost relates to the ability to cheaply verify the attributes of a transaction. The second one to the ability to bootstrap and operate a marketplace without the need for a traditional intermediary: When combined with a native token (as in Bitcoin and Ethereum), a blockchain allows a decentralized network of economic agents to agree, at regular intervals, about the true state of shared data. This shared data can represent exchanges of currency, intellectual property, equity, information or other types of contracts and digital assets - making blockchain a general purpose technology that can be used to trade scarce, digital property rights and create novel types of digital platforms. The resulting marketplaces are characterized by increased competition, lower barriers to entry and innovation, lower privacy and censorship risk, and allow participants within the same ecosystem to make investments to support and operate shared infrastructure without assigning market power to a platform operator. They also challenge the existing revenue models and accumulated knowledge and resources of incumbents, and open opportunities for new approaches to startup fundraising, the provision of public goods and software protocols, data ownership and licensing, auctions and reputation systems.

Keywords: blockchain, cryptocurrency, market design, tokens, initial coin offerings, ICOs, smart contracts, distributed ledgers, Bitcoin, Ethereum, open source, auctions

HOW BLOCKCHAIN AND CRYPTOCURRENCIES WILL IMPACT THE DIGITAL ECONOMY

SOME SIMPLE ECONOMICS OF the blockchain:

CHRISTIAN CATALINI'S TALK AT THE 2017 MIT ICT Conference

MIT IDE Economic Frontiers Podcast on

"The Economics of the Blockchain and Digital Currencies" with Christian Catalini

January 23rd, 2017

This paper uses data from the MIT digital currency experiment to shed light on consumer behavior regarding commercial, public and government surveillance. The setting allows us to explore the apparent contradiction that many cryptocurrencies offer people the chance to escape government surveillance, but do so by making transactions themselves public on a distributed ledger (a `blockchain'). We find three main things. First, the effect of small incentives may explain the privacy paradox, where people say they care about privacy but are willing to relinquish private data quite easily. Second, small costs introduced during the selection of digital wallets by the random ordering of featured options, have a tangible effect on the technology ultimately adopted, often in sharp contrast with individual stated preferences about privacy. Third, the introduction of irrelevant, but reassuring information about privacy protection makes consumers less likely to avoid surveillance at large.

We are interested in finding post-docs or visitors with strong computer science background in applied machine learning. If interested, please contact us.

THE MIT DIGITAL CURRENCY EXPERIMENT

HOW BLOCKCHAIN WILL TRANSFORM

THE DIGITAL ECONOMY

Moderator: Prof. Christian Catalini, Assistant Professor, MIT Sloan (@ccatalini).

Panelists: Anders Brownworth, Principal Engineer, Circle (@anders94) Peter Nichol, Principal, PA Consulting Group (@PeterBNichol) Simon Peffers, Senior Software Architect, Intel (#SimonPeffers) Matthew Utterback, Co-Founder, Rex Mercury, Inc. (#MattUtterback)

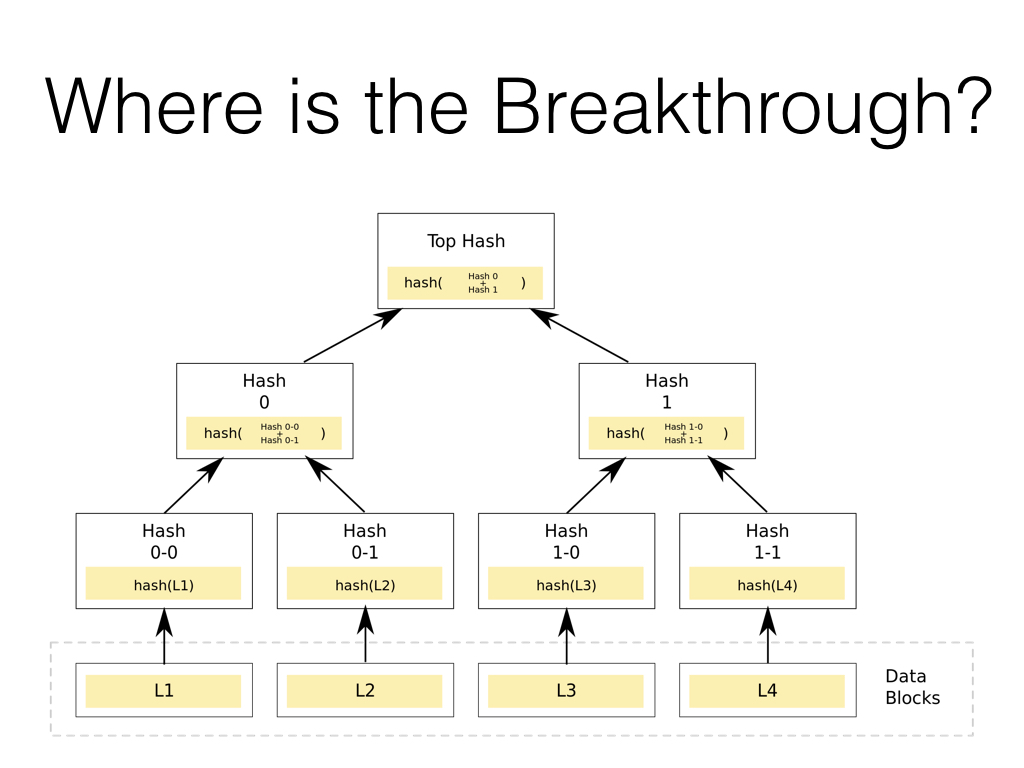

HOW DOES A BLOCKCHAIN WORK?

By Anders Brownworth. To try Anders' live blockchain demo, click here.

WHAT IS BLOCKCHAIN? A SHORT INTRODUCTION

RESEARCH STUDY:

DIGITAL CURRENCIES AND INNOVATION ON THE MIT CAMPUS

Launched: November 2014

The objective of the study is to understand the process of diffusion of Bitcoin, a software-based, open-source, peer-to-peer payment system on the MIT campus. Bitcoin is an innovative payment network that allows for instant peer-to-peer transactions with zero or very low processing fees on a worldwide scale.

From the perspective of a user, Bitcoin is very similar to digital cash, with the additional benefit of being able to prove that a transaction actually took place because of the presence of a digital public ledger. The ledger tracks every transaction using digital wallet addresses that can be thought of as pseudonyms: when transacting with Bitcoin, a user is like a writer that publishes under a pseudonym, i.e. if her/his identity is ever linked to the pseudonym (the Bitcoin address), then all the work (transactions) can be linked back to her/him.

The technology has the potential of dramatically changing how we conduct transactions on a global scale, as it offers secure payments without the necessity of a costly and often slow intermediary. This could disproportionately help segments of the population that are currently underserved by financial intermediaries as well as countries with weak financial institutions.

With this research project the MIT community will have the opportunity not only to shape the evolution of digital currencies, but also to improve the lives of everyone who will use the follow-on inventions that our campus could deliver.

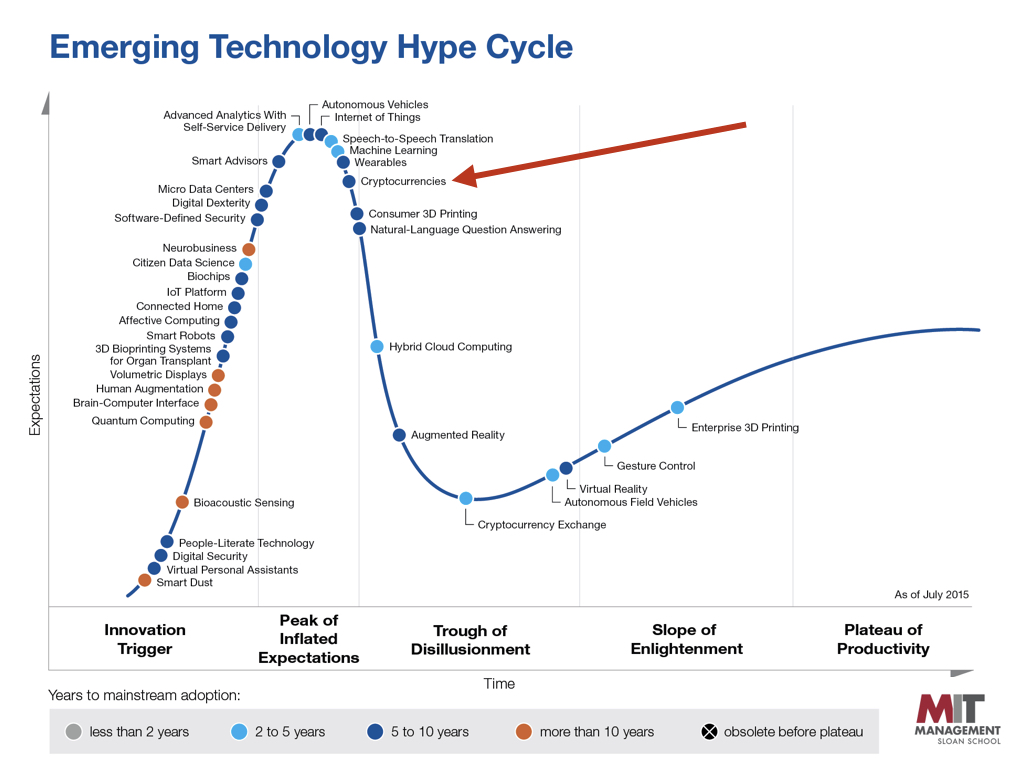

The Bitcoin ecosystem currently resembles the state of the Internet in the mid-90s, i.e. many of the applications that will be built on top of it have not been created. This offers a unique experience for the most inventive and entrepreneurial students at MIT, as they will have a chance to experiment and test their ideas within a campus where the diffusion of digital currencies will be years ahead of anywhere else. Essentially, participants will be the first ones to see the opportunities and possibilities the technology opens up.

In the same way that MIT gave students early access to computing resources through the Athena project in 1983, this project intends to give participants early access to a digital currency. The ultimate objective is to place the broader MIT community at the frontier of this new exciting wave of innovation.